Season Tickets

$300

Enjoy a 42% discount by purchasing all 8 programs in advance

SEPTEMBER 24, 2020

The Road Between Subchapter C and Subchapter S

Larry J. Brant

OCTOBER 29, 2020

Partnership Equity

Bahar A. Schippel

NOVEMBER 12, 2020

1031 Transactions

Max Hansen & Jim Miller

DECEMBER 3, 2020

Deferred Compensation in M&A Transactions

Larry Goldberg

JANUARY 14, 2021

Reliance on IRS Guidance

Stephanie Hunter McMahon

APRIL 22, 2021

IRS Appeals

Sheri A. Dillon

MAY 27, 2021

Partnership Audits

Megan L. Brackney

JUNE 17, 2021

Business Succession Planning

Jerome M. Hesch, Esq.

AGENDA

7:30–7:45am Short Program

7:45–9:00am Featured Speaker

WHERE

This is an online event. You will receive instruction on how to join the webinars once you've registered.SILVER SPONSORS

For information on Gold and Silver Sponsorships, click here or contact Joe Hagen (503) 227-2900.

The Portland Tax Forum announces the return of our tax topic programs. This year we offer eight stimulating lectures from nationally recognized speakers, all conducted online. CPE, CLE, and CFP CE credit is still available and all programs can be transferred to others in your firm.

SEPTEMBER 24, 2020

The Road Between Subchapter C and Subchapter S

Larry J. Brant

Larry Brant, Principal at Foster Garvey PC, focuses on assisting public and private companies, partnerships, and high-net-worth individuals with tax planning and advice, tax controversy, and business transactions. He regularly advises clients in entity selection and formation, structuring mergers and acquisitions, joint ventures and other business transactions.

For complete bio, please visit www.pdxtaxforum.org.

OCTOBER 29, 2020

Partnership Equity

Bahar A. Schippel

Bahar Schippel specializes in tax planning for mergers and acquisitions, joint ventures and real estate transactions, drafting LLC and partnership agreements, tax planning in connection with fund formation and operations, structuring tax-efficient debt workouts, designing service provider equity compensation for LLCs and partnerships and representing taxpayers before the Internal Revenue Service.

For complete bio, please visit www.pdxtaxforum.org.

NOVEMBER 12, 2020

1031 Transactions

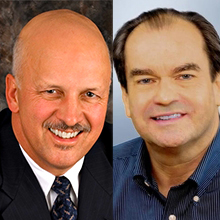

Max Hansen & Jim Miller

Max A. Hansen, Managing Director at Accruit, has helped taxpayers and real estate professionals successfully complete property exchanges for over 40 years.

Jim Miller is a Senior Vice President and Western Operations Counsel for IPX1031. Prior to joining IPX1031 in 2003, Jim was a mortgage banker for six years in Arizona and he practiced law for 14 years in the State of New York.

For complete bio, please visit www.pdxtaxforum.org.

DECEMBER 3, 2020

Deferred Compensation in M&A Transactions

Larry Goldberg

Larry Goldberg, Partner at ESOP Law Group, LLP, focuses on the design, implementation, and operation of Employee Stock Ownership Plans (ESOPs).

For complete bio, please visit www.pdxtaxforum.org.

JANUARY 14, 2021

Reliance on IRS Guidance

Stephanie Hunter McMahon

Professor Stephanie McMahon teaches courses in tax law and legal history, and her research often combines her interest in these areas. Professor McMahon’s scholarship focuses on the historical relationship between taxation and the public’s perception of taxation and, from that relationship, discovers lessons for improving today’s law.

For complete bio, please visit www.pdxtaxforum.org.

APRIL 22, 2021

IRS Appeals

Sheri A. Dillon

Sheri Dillon, Partner at Morgan Lewis, focuses on federal tax controversy matters, guiding clients through IRS examinations and appeals, the administrative claims process, and litigation. Sheri also counsels clients on a variety of business and tax-planning matters that involve acquisitions, dispositions, combinations, and debt restructuring and reorganizations, with a special focus on partnership transactions and closely held businesses.

For complete bio, please visit www.pdxtaxforum.org.

MAY 27, 2021

Partnership Audits

Megan L. Brackney

Megan Brackney, Partner at Kostelanetz & Fink LLP, has a distinguished track record of delivering exceptional results for clients facing complicated and difficult tax issues. An expert in the interplay between civil and criminal tax controversies, Ms. Brackney develops innovative strategies to resolve compliance concerns, civil audits, and criminal investigations.

For complete bio, please visit www.pdxtaxforum.org.